Former Venture Capitalist Brings Smart Financial Advice to Those Who Need It Most, Not Just the Wealthy

Will Peng’s Mission to Make Financial Wellness Accessible to All

As a recent Princeton graduate with over $35,000 in student loan debt, Will Peng knew firsthand the struggle of navigating complex financial decisions. He sought advice from his immigrant parents, who suggested exploring refinancing options and building an emergency fund. However, after researching online and reading articles on NerdWallet, Peng realized that he was likely not alone in his struggles.

The Birth of Northstar

This realization sparked the idea for Peng’s startup, Northstar. Recognizing that financial advisory services were often reserved for the affluent, Peng decided to partner with employers to offer a financial wellness benefit to their employees. As he explained, "We want to build financial wellness for the 100%, not just the 1%."

Personal Financial Management Tools

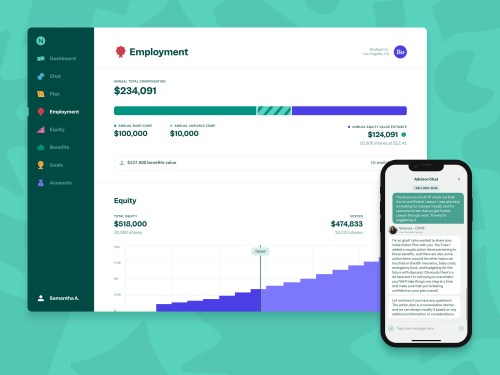

Northstar has developed a comprehensive set of personal financial management tools to guide employees through various financial and life situations. These tools aim to help employees understand the full value of their compensation, equity, and benefits. While many clients are in the tech space, Northstar’s services range across industries, including private and public companies.

Employer Partnerships

For a monthly subscription fee, employers can provide their employees with access to Northstar’s financial advisors, who offer personalized guidance on topics such as investment strategies, budgeting, and retirement planning. The company currently has partnerships with over 50 employers worldwide.

Global Expansion

With its new round of financing, Northstar plans to double or triple its headcount, expanding its reach into an additional 20 countries by the end of 2023. Hans Tung, managing partner at GGV Capital and a member of Northstar’s board, commented on his firm’s investment in the company: "We invested in Northstar because it shares our vision that financial wellness should be universal for all employees."

A Universal Vision

Tung continued, "Financial advice has been around for many years, yet most consumers do not have access to financial advisors at affordable rates and enabled by tech, creating a huge market." GGV Capital’s investment in Northstar is part of its broader strategy to democratize technology for underserved markets.

Northstar’s Mission

Peng’s mission with Northstar is clear: make financial wellness accessible to all employees. With a growing team and expanding global reach, the company is well on its way to achieving this goal. As Peng stated, "We believe that everyone deserves access to high-quality financial advice, regardless of their background or income level."

A Bright Future Ahead

With its innovative approach to financial wellness, Northstar has the potential to revolutionize the way employees manage their finances. By providing personalized guidance and support, the company is helping to empower individuals to take control of their financial futures.

As Northstar continues to grow and expand, it will be exciting to see how this mission-driven startup makes a lasting impact on the world of finance. With its commitment to accessibility and affordability, Northstar is poised to become a leader in the field of financial wellness.