Obie, a landlord-focused insurtech startup, has secured $25.5 million in funding led by Battery Ventures.

Company Sees Significant Growth, Expands Insurance Offerings to 75 Proptech Partners

Obie, a real estate-focused insurance technology company, has raised $25.5 million in a funding round led by Battery Ventures. This latest raise brings Obie’s total funding to $39 million since its inception in 2017.

From $3 Billion to $20 Billion: Obie’s Explosive Growth

Since the company’s last raise of $10.4 million Series A nearly two years ago, Obie has experienced explosive growth. The startup now secures insurance for over $20 billion worth of property, up from just over $3 billion in 2021. This significant increase is a testament to Obie’s innovative approach and commitment to providing instant quotes and competitive premiums.

Instant Quotes and Competitive Premiums

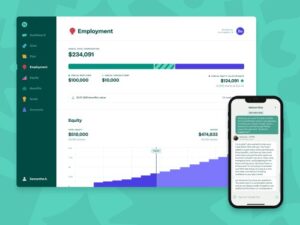

Obie’s software specifically targets small-to-medium size apartment landlords who own single-family rentals and/or larger apartment buildings. The company claims that its platform stands out from the competition by offering:

- Instant quotes: Obie provides quotes in just five minutes, making it easier for policyholders to secure insurance.

- Competitive premiums: Obie’s platform can save policyholders up to 25-30% compared to other insurance premiums.

Partnerships with Over 75 Proptech Companies

Obie has formed partnerships with more than 75 proptech companies, including Roofstock, Flock Homes, Baselane, Awning, and Marketplace Homes. These collaborations enable Obie to offer its insurance solutions directly to real estate investors through various online channels.

300% Growth in Written Premiums

In the past two years, Obie has seen a 300% growth in written premiums. This remarkable increase is a direct result of the company’s focus on providing innovative solutions for the real estate industry.

Increased Margins and Valuation

Obie’s COO and co-founder Aaron Letzeiser stated that the company has increased its margins by 40% over the last year. Additionally, Obie is on track to improve another 25% in margin growth by the end of 2023.

A Growing Market for Landlord Insurance

There are over 18 million residential real estate investors in the U.S., with more than 90% being small ‘mom and pop’ investors who spend over $60 billion a year on insurance premiums. This vast market presents significant opportunities for Obie to continue its growth trajectory.

Battery Ventures’ Support

Battery Ventures General Partner Michael Brown expressed his confidence in Obie’s unique approach to landlord insurance:

"Obie’s focus on this market — and its savvy use of data, proprietary risk-management tools, and embedded industry partnerships — has allowed it to develop a unique system to generate near-instant, competitive quotes that landlords can access anywhere they’re buying or managing property."

Conclusion

Obie’s $25.5 million funding round demonstrates the company’s commitment to expanding its insurance offerings and further establishing itself as a leader in the proptech industry. With over 75 partnerships and a growing market for landlord insurance, Obie is well-positioned for continued growth and success.

Obie’s Key Statistics

- $25.5 million raised in latest funding round

- Total funding: $39 million since inception

- $20 billion worth of property secured through insurance

- 300% growth in written premiums over past two years

- Increased margins by 40% over last year

- Partnered with over 75 proptech companies

Battery Ventures’ Key Quotes

- "Obie’s focus on this market — and its savvy use of data, proprietary risk-management tools, and embedded industry partnerships — has allowed it to develop a unique system to generate near-instant, competitive quotes that landlords can access anywhere they’re buying or managing property."

— Michael Brown, Battery Ventures General Partner